What Are Synthetic Indices?

Bridge Markets’ Synthetic Indices are financial instruments created using controlled random generation algorithms (RNG – Random Number Generator) that simulate market movements based on volatility, trends, and real behavioral patterns.

These indices do not depend on physical assets (such as stocks or currencies) or external news. Instead, they replicate the dynamic conditions of real financial markets:

uptrends, downtrends, impulses, consolidations, and breakouts.

As a result, you can trade under clear and consistent rules, with stable conditions, 24/7 availability, and without the uncertainty caused by global events.

Advantages of Trading Synthetic Indices

Available 24/7

Trade without interruptions, 365 days a year. Synthetic indices never close, never sleep, and never stop.

Full transparency

Every price movement is generated by an audited random system, ensuring impartiality and statistical consistency.

Controlled volatility

Each family of indices has predefined volatility levels or movement structures, allowing you to choose the profile that best fits your strategy.

No external news influence

Forget about macroeconomic events that distort the market. Here, conditions are purely technical.

Ideal for algorithmic trading

Designed for bots, quantitative strategies, and backtesting in consistent trading environments.

Measurable risk and constant opportunities

Thanks to the mathematical nature of their price series, you can build more predictable systems and achieve better risk management.

Our Synthetic Index Families

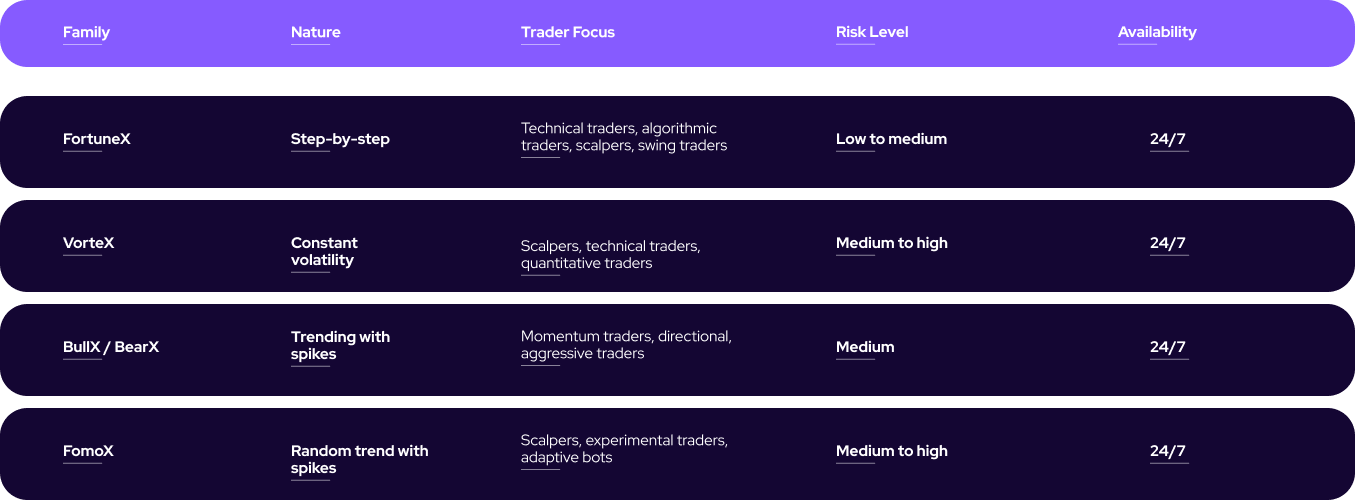

Bridge Markets groups its indices into four main families, each with a distinctive behavior and a specific trading purpose.

Discover which one best fits your trading style.

Comparison and Organization of Families

Each family of Bridge Markets indices was designed to represent a distinct facet of the market:

Each index was created to serve as a real strategy laboratory, without relying on the real world.

How to Trade Them

Choose your family:

Decide whether you’re looking for stability, trend-following behavior, or controlled chaos.

Define your strategy:

Use your own indicators or test your bots in 100% repeatable environments.

Manage risk:

Each index has its own volatility “personality.” Adjust your position size and stops accordingly.

Analyze patterns:

Bridge Markets indices offer consistency, making them ideal for backtesting..

Enjoy the process:

Here, every tick is an opportunity to improve.

Technical Specifications of Our Synthetic Indices:

Each index family has been designed with precise parameters that reflect different market behaviors, volatility levels, and operational depth.

Below are the spread values, minimum lot size, trading limits, and cost per tick, which define the operational structure of each instrument.

The synthetic indices of Kinero Markets are calibrated to deliver a transparent, stable trading experience free from external manipulation, ensuring consistent conditions for both high-frequency strategies and medium-term trades.

Explore. Learn. Trade. Evolve.

Dive into the synthetic indices ecosystem of Bridge Markets and discover a new level of freedom and operational precision.